Retire Richer: The 9 Best States with No Income Tax for Retirees (2025 Guide)

Are you planning your retirement around your passions, or around tax deadlines? For many Americans, the dream of a golden-years adventure is eroded by the silent erosion of taxes. But what if you could add years of financial freedom to your life simply by changing your address? This guide isn’t just a list; it’s a data-driven roadmap to the nine states where you can strategically minimize your tax burden and maximize your retirement lifestyle.

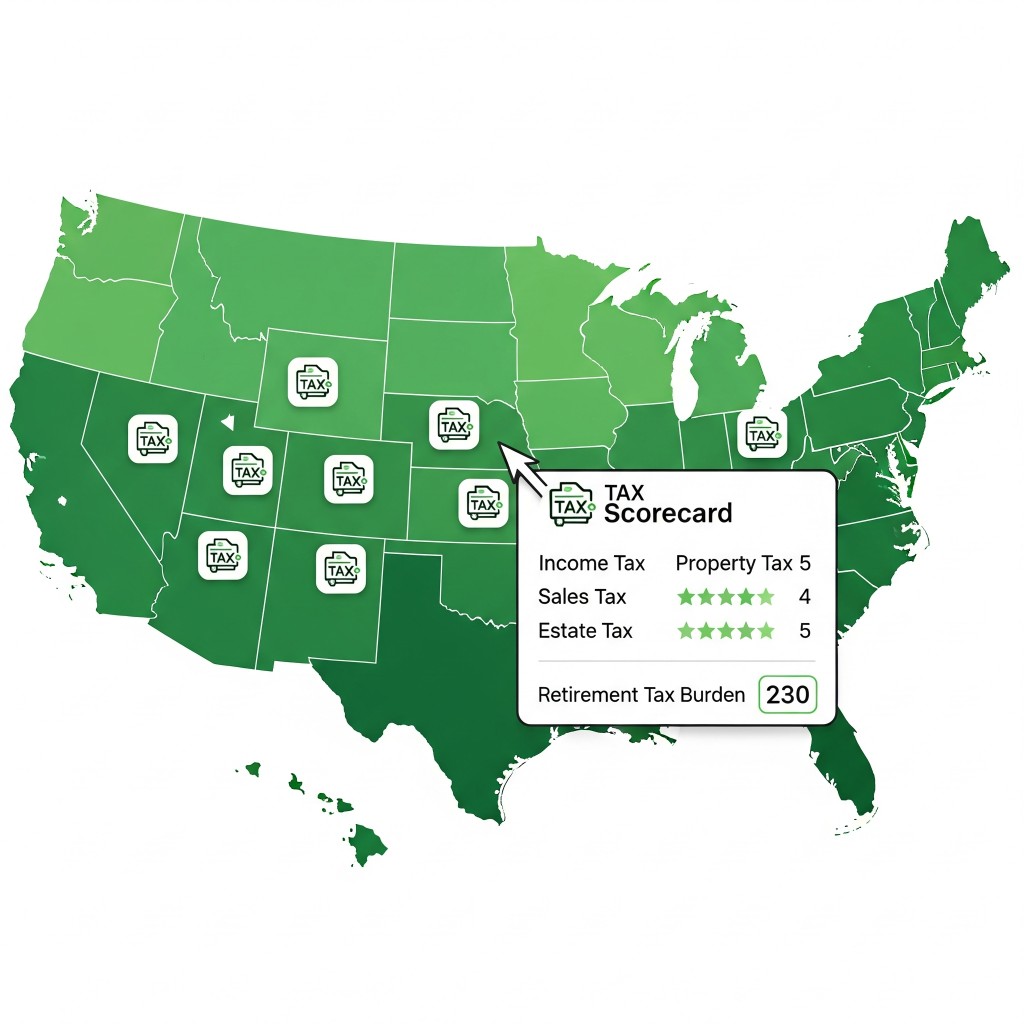

The conversation about retirement taxes often begins and ends with income tax. This is a critical, but incomplete, part of the puzzle. A state with zero income tax might levy high property or sales taxes that could ultimately cost you more. To truly retire richer, you must analyze the full picture. We’ve done the work for you, creating a “Total Tax Scorecard” for each of the nine states that currently have no broad-based personal income tax.

The Core Question: It’s not just “How much will I pay in income tax?” but “How much of my retirement income will I actually keep?”

The “Total Tax Scorecard” Explained

We’ve evaluated each state based on four key metrics that directly impact a retiree’s wallet:

- State Income Tax: The most visible tax. All states on our list score a perfect 10/10 here.

- Property Tax Burden: A measure of the average property tax paid as a percentage of home value. A lower burden means more money in your pocket. [External Link: Tax Foundation Property Tax Data]

- Sales Tax (State + Average Local): The everyday tax that can significantly add up. We consider the combined state and average local rate.

- Tax on Social Security: Does the state tax your Social Security benefits? For retirees, this is a crucial factor.

The 9 Tax-Havens for Retirees: A State-by-State Analysis

1. Wyoming: The Cowboy State’s Surprising Tax Advantage

Often overlooked, Wyoming offers a potent combination of non-existent income tax and a low overall tax burden, making it a frontier of financial freedom for retirees.

Wyoming Tax Scorecard:

– Income Tax: None

– Property Tax Burden: Very Low (Avg. 0.58%)

– Sales Tax: Low (Avg. 5.44%)

– Social Security Tax: None

The Insight: With one of the lowest property tax rates in the nation and no tax on your retirement income, Wyoming allows your nest egg to grow with minimal interference. It’s an ideal choice for those who value fiscal conservatism and open spaces.

2. Nevada: More Than Just Bright Lights

Look past the Las Vegas Strip, and you’ll find a state with a very retiree-friendly tax structure. Nevada’s lack of income tax is a major draw, but its treatment of other assets is equally compelling.

Nevada Tax Scorecard:

– Income Tax: None

– Property Tax Burden: Very Low (Avg. 0.56%)

– Sales Tax: High (Avg. 8.24%)

– Social Security Tax: None

The Insight: Nevada balances its higher-than-average sales tax with extremely favorable property taxes. If you’re a homeowner who is mindful of your spending on goods, Nevada offers a winning formula.

3. South Dakota: The Quiet Contender

For those seeking a peaceful retirement with a rock-solid financial foundation, South Dakota presents a compelling case. It’s a state that truly lets retirees keep what they’ve earned.

South Dakota Tax Scorecard:

– Income Tax: None

– Property Tax Burden: Moderate (Avg. 1.17%)

– Sales Tax: Low (Avg. 6.11%)

– Social Security Tax: None

The Insight: While its property taxes are higher than some on this list, South Dakota’s low sales tax and complete absence of income or Social Security tax make it a financially serene place to retire.

4. Florida: The Sunshine State’s Tax Appeal

There’s a reason Florida is a classic retirement destination, and it’s not just the weather. Its tax policies are explicitly designed to attract and keep retirees.

Florida Tax Scorecard:

– Income Tax: None

– Property Tax Burden: Moderate (Avg. 0.91%)

– Sales Tax: Moderate (Avg. 7.02%)

– Social Security Tax: None

The Insight: Florida offers a balanced approach. While not the absolute lowest in every category, its lack of income tax and no estate or inheritance tax provides a predictable and stable financial environment.

5. Alaska: The Last Frontier of Tax Savings

For the adventurous retiree, Alaska offers an unparalleled tax environment. Not only does it forgo an income tax, but it also has no state-level sales tax.

Alaska Tax Scorecard:

– Income Tax: None

– Property Tax Burden: Moderate (Avg. 1.03%)

– Sales Tax: Very Low (Avg. 1.81% – local only)

– Social Security Tax: None

The Insight: Alaska is in a league of its own. The absence of both income and state sales tax is a powerful combination. Add in the Permanent Fund Dividend (an annual payment to residents), and your retirement finances could look very healthy indeed.

6. Tennessee: The Volunteer State’s Welcoming Tax Laws

With a rich culture and low cost of living, Tennessee’s tax structure makes it even more attractive for those looking to stretch their retirement dollars.

Tennessee Tax Scorecard:

– Income Tax: None

– Property Tax Burden: Low (Avg. 0.67%)

– Sales Tax: Very High (Avg. 9.55%)

– Social Security Tax: None

The Insight: Tennessee represents a trade-off. It has one of the highest combined sales taxes in the country, but this is offset by low property taxes and no tax on your retirement income streams. It’s a state that rewards savers and homeowners.

7. Texas: Big State, Small Tax Burden

The Lone Star State’s famous “no income tax” policy is just the beginning of its appeal for retirees. Its vibrant economy and independent spirit are reflected in its fiscal policies.

Texas Tax Scorecard:

– Income Tax: None

– Property Tax Burden: High (Avg. 1.63%)

– Sales Tax: High (Avg. 8.20%)

– Social Security Tax: None

The Insight: Texas requires careful planning. The high property taxes are a significant factor for homeowners. However, for retirees who may be downsizing or renting, the lack of an income tax can lead to substantial savings.

8. Washington: The Evergreen State’s Modern Tax Structure

Washington’s tax system is a reflection of its modern economy. It forgoes a traditional income tax in favor of other revenue sources, which can be advantageous for retirees.

Washington Tax Scorecard:

– Income Tax: None (Note: A 7% tax on capital gains over $250,000 exists)

– Property Tax Burden: Moderate (Avg. 0.87%)

– Sales Tax: High (Avg. 8.86%)

– Social Security Tax: None

The Insight: For most retirees, Washington’s lack of income tax is a clear win. The new capital gains tax primarily affects very high earners or those with significant investment events. Its overall profile is favorable, but requires awareness of this nuance.

9. New Hampshire: The “Live Free or Die” Tax Philosophy

New Hampshire takes its motto seriously, especially when it comes to taxes. It is one of the few states with neither a broad income tax nor a state sales tax.

New Hampshire Tax Scorecard:

– Income Tax: None on earned income (Note: 5% tax on interest and dividends is being phased out)

– Property Tax Burden: Very High (Avg. 1.89%)

– Sales Tax: None

– Social Security Tax: None

The Insight: New Hampshire is a case study in fiscal trade-offs. The lack of income and sales tax is a massive benefit for spenders and earners. However, it funds its government through some of the highest property taxes in the nation. This state is perfect for retirees who plan to rent or have a modest home but want to be free from taxes on their spending and retirement income.

Conclusion: Beyond the Numbers, A Strategy for Life

Choosing where to retire is one of the most significant financial decisions you’ll ever make. As we’ve seen, a “no income tax” label doesn’t automatically equate to the lowest tax bill. The data reveals a crucial insight: the best state for you depends on your personal financial profile.

Are you a homeowner with a large property? Wyoming or Nevada may be your haven. Are you a renter who enjoys shopping? New Hampshire could be your paradise. The key is to move beyond one-dimensional thinking and embrace a holistic view of your tax burden.

By using this guide, you can shift the focus from simply saving for retirement to strategically planning a richer one—where more of your money stays yours, funding your dreams, not the taxman.

This article is for informational purposes only and should not be considered financial advice.