How the US-China Trade War Could Affect Your Retirement Income (And What to Do About It)

For decades, you did everything right. You saved diligently, invested wisely, and built a nest egg designed to last a lifetime. Now, in retirement, the goal has shifted from accumulation to preservation. But suddenly, distant headlines about trade wars and tariffs feel like a new and unpredictable threat to the financial security you worked so hard to achieve. You’re not imagining it. The US-China trade war isn’t just a political chess match; it’s a force that can create two hidden leaks in your retirement reservoir: the slow drain of inflation and the sudden shocks of market volatility.

This article is not about panic. It is about empowerment. We will demystify how these global tensions connect directly to your wallet. More importantly, we will provide a clear, prudent action plan to help you fortify your finances and navigate this new economic landscape with confidence.

The Two Hidden Leaks in Your Retirement Income

The impact of the trade war on your retirement income isn’t always obvious. It rarely appears as a line item on your statements. Instead, it manifests as a slow erosion of purchasing power and a sudden increase in portfolio anxiety. Let’s break down these two effects.

Leak #1: The Slow Drain of Inflation (Your Money Buys Less)

Think of tariffs as a silent tax on your fixed income. Your pension or Social Security check might show the same dollar amount, but its real-world value decreases. This is the core inflation impact on fixed income. When the U.S. imposes tariffs on Chinese goods—from electronics and furniture to clothing and auto parts—the cost of importing those items rises. Businesses, facing higher costs, typically pass them on to consumers. The result? The price of everyday goods creeps up, and your retirement income doesn’t stretch as far as it used to.

“As numerous studies from economists at institutions like the Peterson Institute for International Economics have shown, the costs of tariffs are overwhelmingly borne by domestic consumers and businesses, not the exporting country. For retirees on a fixed income, this translates directly to a higher cost of living.”

This gradual erosion of purchasing power is one of the most significant, yet least visible, risks to long-term retirement security. [Internal Link: A Retiree’s Guide to Understanding Inflation]

Leak #2: The Shockwaves of Volatility (Your Investments Fluctuate)

Many retirees rely on a portfolio of what they believe are “safe” blue-chip dividend stocks for income. However, in today’s globalized world, many of these giants are like massive cargo ships with anchors in ports all over the world, especially China. A trade dispute is like a storm in a major port; it sends shockwaves that can rock the entire ship. This is the essence of geopolitical risk to retirement portfolio.

When new tariffs are announced, companies with significant sales in China or critical links in their supply chain there often face immediate challenges. They may issue profit warnings, leading to sharp declines in their stock price. This volatility can be deeply unsettling for retirees who depend on portfolio stability and a reliable stream of dividends. The perceived safety of a stock must now be re-evaluated through the lens of its global exposure, a crucial step to protect retirement savings from stock market volatility.

Understanding the global economic outlook is crucial. [External Link: The International Monetary Fund’s (IMF) Global Economic Outlook]

Your 4-Step Action Plan to Fortify Your Finances

Understanding these risks is the first step. Taking control is what comes next. Here is a prudent, four-step action plan to turn anxiety into action and reinforce your financial defenses.

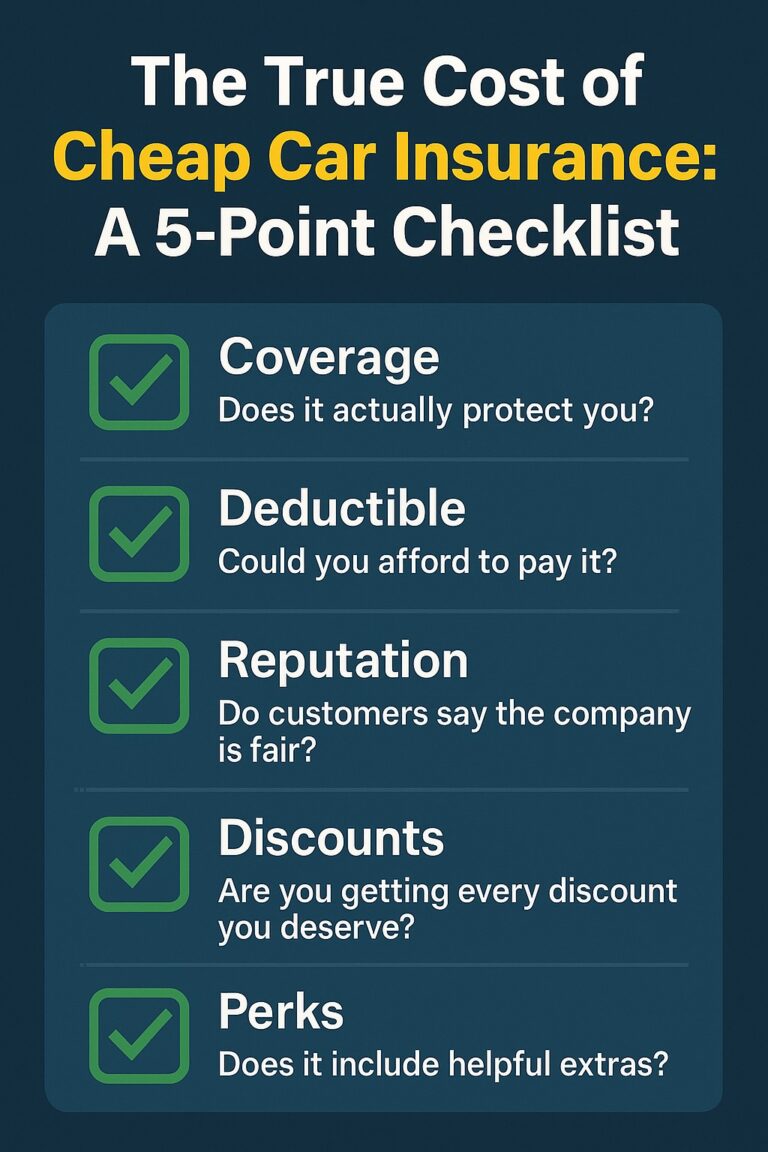

The Prudent Retiree’s Checklist

- Stress-Test Your Budget: Quantify the impact of potential inflation on your actual expenses.

- X-Ray Your Portfolio: Uncover hidden geographic risks in your funds and stocks.

- Consider an Inflationary Shield: Explore assets designed to protect your purchasing power.

- Re-evaluate “Safety” in Dividends: Prioritize resilience and domestic focus over just high yields.

Step 1: Stress-Test Your Budget for Inflation

Don’t guess—calculate. Take your average monthly expenses and see what a 3%, 5%, or even 7% increase looks like. How does that change your cash flow? Does it impact your ability to cover discretionary spending? This simple exercise transforms a vague fear into a concrete number you can plan around.

Step 2: X-Ray Your Portfolio for Geographic Risk

Look deeper than the stock ticker. For your top ten holdings or largest mutual funds, do a little homework. Visit the company’s investor relations page or the fund’s website to find what percentage of revenue is derived from Asia or China. You may find that some of your ‘safe’ US stocks have significant foreign exposure, a key risk to your dividend stock safety.

Step 3: Consider an Inflationary Shield

One of the most direct ways to protect against inflation is to own assets designed to counter it. Treasury Inflation-Protected Securities (TIPS) are a primary example. These are government bonds where the principal value increases with inflation, ensuring your investment keeps pace with rising costs. Discuss with a financial advisor whether an allocation to TIPS or other inflation-hedging assets makes sense for your specific situation. These can be some of the safe investments for retirees in an inflationary environment.

Step 4: Re-evaluate “Safety” in Your Dividend Stocks

In this new era, the definition of a “safe” dividend stock is evolving. A company with a high yield but a vulnerable, China-dependent supply chain may be riskier than a company with a more modest yield but a resilient, domestically-focused business model. It’s time to prioritize the *quality and resilience* of the dividend, not just its size. [Internal Link: 5 Tariff-Proof Stocks for Your Portfolio]

Conclusion: From Passive Concern to Proactive Planning

The goal is not to liquidate your assets and hide in cash. It is to be informed, deliberate, and proactive. The US-China trade war is a complex issue, but its effects on your retirement can be managed with a clear-eyed strategy.

By stress-testing your budget, understanding the true geographic exposure of your portfolio, and strategically incorporating assets that offer resilience, you can move from a position of passive concern to one of active control. In today’s world, true financial security in retirement comes from understanding how global events connect to your personal finances and taking measured steps to build a more durable and resilient plan for the years ahead.

This article is for informational purposes only and should not be considered financial advice.