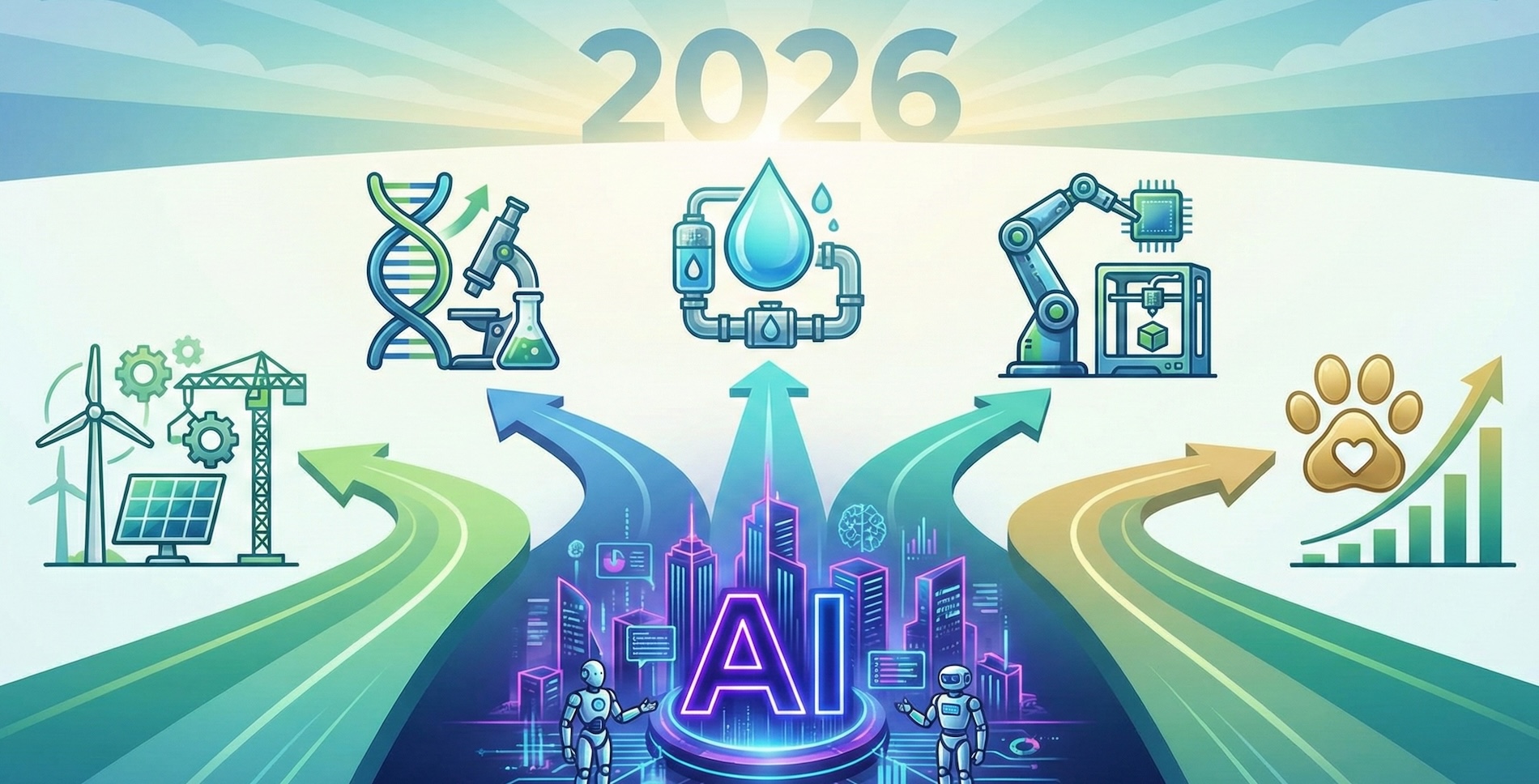

Beyond AI: The 5 Unexpected Growth Sectors Poised to Dominate 2026

The AI boom of the last few years was a tidal wave, lifting portfolios and capturing the world’s imagination. But for forward-thinking investors, the question always remains: what’s the next wave? Chasing the last rally is a recipe for buying high, but identifying the deep, underlying currents of change is how generational wealth is built. These powerful, long-term investment themes for 2026 are already gathering strength, far from the glare of the AI spotlight.

This report moves beyond the obvious to identify five sectors driven by powerful secular trends—unstoppable shifts in policy, demographics, and technology. These are the areas where the smart money is quietly accumulating positions for the decade ahead. For each, we’ll explain the bull case and recommend a simple ETF to gain diversified exposure.

1. The New Grid: Investing in Infrastructure and Clean Energy

The transition to a green economy isn’t a political talking point; it’s a multi-trillion-dollar industrial reality. With legislative tailwinds like the Inflation Reduction Act providing hundreds of billions in incentives, the modernization of the world’s energy infrastructure is a non-negotiable trend for the coming decade.

- The Bull Case: Decades of underinvestment in electrical grids, combined with the explosive energy demand from data centers and electric vehicles, create a perfect storm for infrastructure spending. This isn’t just about solar panels; it’s about transmission lines, battery storage, and smart grid technology.

- How to Invest: The iShares Global Clean Energy ETF (ICLN) provides broad exposure to companies involved in solar, wind, and other renewable sources, making it a cornerstone for investing in infrastructure and clean energy.

2. The Longevity Revolution: Biotechnology Stocks to Watch

Post-COVID innovation, particularly in mRNA and gene-editing technologies like CRISPR, has unlocked a new era in medicine. Combined with an aging global population, the demand for novel therapies for chronic diseases like cancer, Alzheimer’s, and diabetes represents one of the most profound secular growth trends investing opportunities.

- The Bull Case: The convergence of big data, AI-powered drug discovery, and new treatment modalities is dramatically shortening development timelines. The market for specialty drugs and personalized medicine is expanding rapidly, creating a long runway for growth.

- How to Invest: For diversified exposure to this cutting-edge sector, the iShares Biotechnology ETF (IBB) holds a portfolio of the largest and most innovative biotech companies. These are the top biotechnology stocks to watch, bundled into a single trade.

3. Liquid Gold: Solving Global Water Scarcity

Often overlooked, water is becoming one of the 21st century’s most critical resources. A combination of climate change, population growth, and industrial demand is creating unprecedented stress on global water supplies. The companies that can purify, transport, and conserve water are positioned for decades of essential growth.

- The Bull Case: Unlike many commodities, there is no substitute for water. Investment is required in everything from advanced filtration systems and desalination plants to smart irrigation and water infrastructure repair. This is a defensive growth sector with inelastic demand.

- How to Invest: The Invesco Water Resources ETF (PHO) is the leading fund in this space, investing in companies that create products designed to conserve and purify water for homes, businesses, and industries.

4. The Reshoring Boom: Robotics and Automation

Geopolitical tensions and supply chain vulnerabilities exposed during the pandemic have kicked off a powerful “reshoring” trend, with companies moving manufacturing capabilities back to their home countries. To remain competitive with higher labor costs, these companies are investing massively in automation.

- The Bull Case: This isn’t just about factory robots. It’s about warehouse logistics, surgical robots, and automated systems in every industry. Labor shortages and wage inflation provide a permanent tailwind for the adoption of automation technology.

- How to Invest: The Global X Robotics & Artificial Intelligence ETF (BOTZ) serves as a premier robotics and automation ETF, holding a global portfolio of companies at the forefront of this industrial transformation.

5. The Humanization of Pets: The Enduring Pet Economy

One of the most resilient demographic trends is the “humanization” of pets. Consumers, particularly Millennials and Gen Z, are increasingly treating their pets as members of the family and spending accordingly on premium food, advanced veterinary care, and discretionary items.

- The Bull Case: Spending on pets is remarkably recession-proof. Owners will cut back on personal luxuries before they skimp on their pet’s health and wellness. This creates a stable, growing market for everything from diagnostics and pharmaceuticals to high-end food and insurance.

- How to Invest: The ProShares Pet Care ETF (PAWZ) is the only ETF specifically targeting the pet care industry, with holdings across veterinary services, diagnostics, pet food, and supplies.

Conclusion: Investing in the Tides, Not the Waves

While the market obsesses over the short-term waves of AI, the powerful undercurrents of these five secular trends are reshaping the global economy. Investing in clean energy, biotechnology, water solutions, automation, and the pet economy isn’t about chasing hype; it’s about positioning your portfolio to be lifted by the inevitable tides of change.

A diversified approach, taking positions in several of these long-term investment themes for 2026, can provide a robust engine for growth for years to come, long after the noise of the current market frenzy has faded.

This article is for informational purposes only and should not be considered financial advice.