Fed Hits Pause: 3 Takeaways from the September FOMC Decision and What It Means for Your Money

The financial world held its breath, and the Federal Reserve has delivered its verdict. In a widely anticipated move, the Federal Open Market Committee (FOMC) announced today that it will hold the federal funds rate steady, pressing the pause button on its aggressive rate-hiking cycle. But to interpret this pause as a sign of dovishness would be a grave misreading of the tea leaves. The real story isn’t in the pause itself, but in the subtle, forward-looking signals that came with it.

Beneath the headline of “no change” lies a complex message about the Fed’s enduring fight against inflation and its forecast for the economic road ahead. For investors and consumers, understanding this nuance is critical. We will dissect the three most important takeaways from the `September FOMC meeting outcome`: the hawkish message hidden within the new “dot plot,” the calculated language from Chair Jerome Powell’s press conference, and what this all means for your investments and loans.

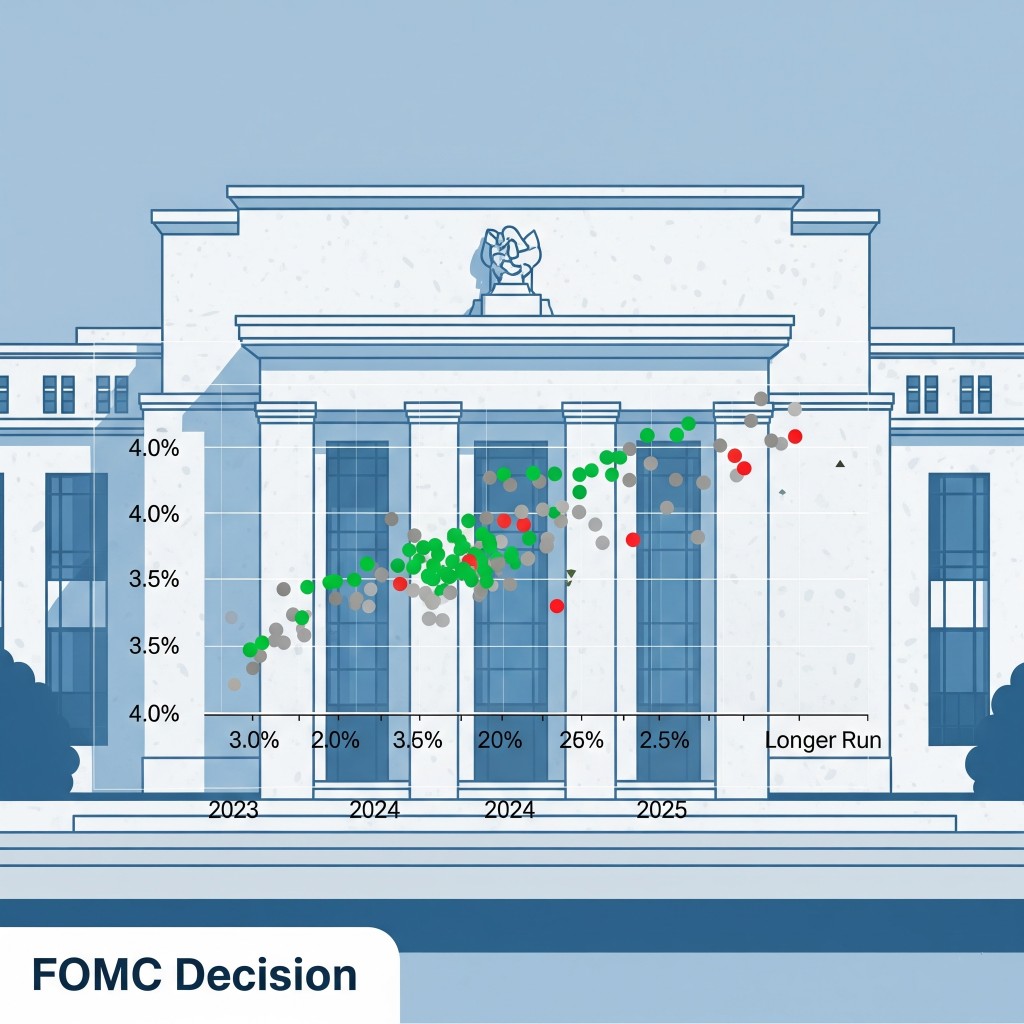

Takeaway 1: The Dot Plot’s Hawkish Whisper: “Higher for Longer” is Real

The most revealing piece of information from any FOMC meeting is often the Summary of Economic Projections, specifically the chart known as the “dot plot.” This chart anonymously maps out where each Fed official expects interest rates to be in the coming years. Today’s plot sent a clear, unambiguous message: the Fed expects to keep interest rates higher for longer than the market had hoped.

While the committee held rates steady now, the median dot for the end of 2026 shifted higher, signaling that fewer rate cuts are anticipated next year than previously projected. This is the data-driven story. The Fed is telling us that while the pace of hikes may be over, the era of restrictive monetary policy is not. They are preparing the market for a high-altitude cruise, not a swift descent.

Key Insight: The market wanted a pivot, but the Fed gave it a plateau. The new dot plot is a deliberate attempt to quash expectations of imminent rate cuts, reinforcing the central bank’s commitment to bringing inflation all the way back to its 2% target, even if it means sustained economic pressure.

Takeaway 2: Powell’s Press Conference: The Art of Cautious Resolve

If the dot plot was the data, Jerome Powell’s press conference was the narrative. The Fed Chair walked a tightrope, acknowledging progress on inflation while simultaneously stressing that the job is far from done. His language was a masterclass in calculated ambiguity, designed to keep the market guessing and prevent a premature easing of financial conditions.

One key quote stood out: “We are prepared to raise rates further if appropriate, and we intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

This is not the language of a central banker ready to declare victory. It’s the language of a firefighter who has contained the blaze but is still watching for hot spots. The `Jerome Powell press conference` effectively communicated that the committee is now in a data-dependent, meeting-by-meeting mode. As Powell himself put it, they are “navigating by the stars under cloudy skies.”

Takeaway 3: The Impact on Your Money – What to Watch Now

The Fed’s policy decisions in Washington D.C. have a direct impact on households across the country. Here’s how the `stock market reaction to Fed` policy and the outlook for your personal finances are shaping up.

For Your Investments:

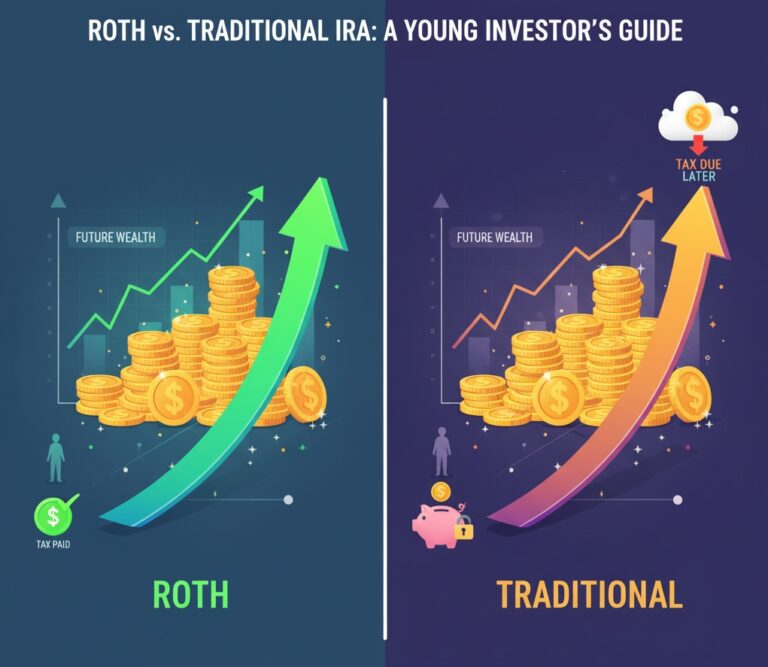

- Stock Market: The “higher for longer” message is typically a headwind for equities, especially growth and tech stocks that are sensitive to higher borrowing costs. Expect continued volatility. Value and dividend-paying stocks in sectors like healthcare and consumer staples may become more attractive in this environment.

- Bond Market: The outlook for higher rates means that yields on short-term government bonds will likely remain elevated. This makes them a genuinely attractive, low-risk place to park cash. The yield curve may remain inverted, a classic signal of economic uncertainty.

For Your Loans and Savings:

- Mortgage Rates: The `future of mortgage rates` remains tied to this policy. While the Fed’s rate isn’t the mortgage rate, it heavily influences it. This decision likely means mortgage rates will stay elevated, remaining a significant hurdle for prospective homebuyers.

- Savings Accounts & CDs: This is the silver lining for savers. Banks will continue to offer high APYs on high-yield savings accounts and Certificates of Deposit (CDs). It remains an excellent time to earn a real return on your cash reserves.

- Credit Cards: APRs on credit cards will remain near record highs. Paying down variable-rate debt should be a top financial priority.

Call-out Box: What to Watch Next

The Fed is now laser-focused on incoming data. Before the next FOMC meeting, all eyes will be on two key reports: the Consumer Price Index (CPI) for inflation data and the monthly Jobs Report for the state of the labor market. Any signs of stubborn inflation or a surprisingly strong labor market could tip the scales toward another hike.

Conclusion: The End of the Beginning, Not the Beginning of the End

The September FOMC meeting was a pivotal moment. It marked a transition from a phase of rapid, aggressive action to one of patient, resolute observation. The Fed has successfully guided the economy to a place where it can pause and assess the full impact of its historic tightening campaign. But this pause is not a promise of relief.

The core message is one of vigilance. For investors and consumers, the takeaway is that the cost of money will remain high, and the path forward for the economy is still uncertain. The easy gains are over, and the focus must now shift from anticipating the Fed’s next move to building financial resilience for a prolonged period of restrictive policy. The storm may be passing, but we are not yet in clear skies.

This article is for informational purposes only and should not be considered financial advice.