Holding NVIDIA? Here’s the Data-Driven Framework to Decide if You Should Sell in 2025

If you’re holding NVIDIA (NVDA) stock, you’re likely experiencing a powerful mix of euphoria and anxiety. You’ve witnessed a historic surge, a testament to the company’s central role in the AI revolution. Yet, with each new high, a nagging question grows louder: “Should I sell my NVIDIA stock now?” This question isn’t just about money; it’s about fear, greed, and the deep-seated desire to not lose what you’ve gained.

This article will not give you a simple “yes” or “no.” Such advice would be irresponsible. Instead, our goal is far more valuable: to provide you with a robust, data-driven framework to make your own informed decision. We will turn your anxiety-fueled question into a structured lesson in advanced portfolio management. By the end, you won’t have a prediction, but something better: a strategy.

Beyond Emotion: The First Step is a Mental Reset

The biggest mistake investors make with a massive winner like NVIDIA is letting emotion take the driver’s seat. The fear of losing unrealized gains can lead to panic-selling too early, while greed can lead to holding on far too long. The first step in any sound financial decision is to acknowledge and then sideline these emotions.

“The investor’s chief problem—and even his worst enemy—is likely to be himself.” – Benjamin Graham

Your goal is not to perfectly time the peak or bottom. That’s a fool’s errand. Your goal is to make a decision that aligns with your financial goals and risk tolerance, a decision you can stand by regardless of the market’s next move. This requires a framework. Let’s build one together, based on three pillars of analysis.

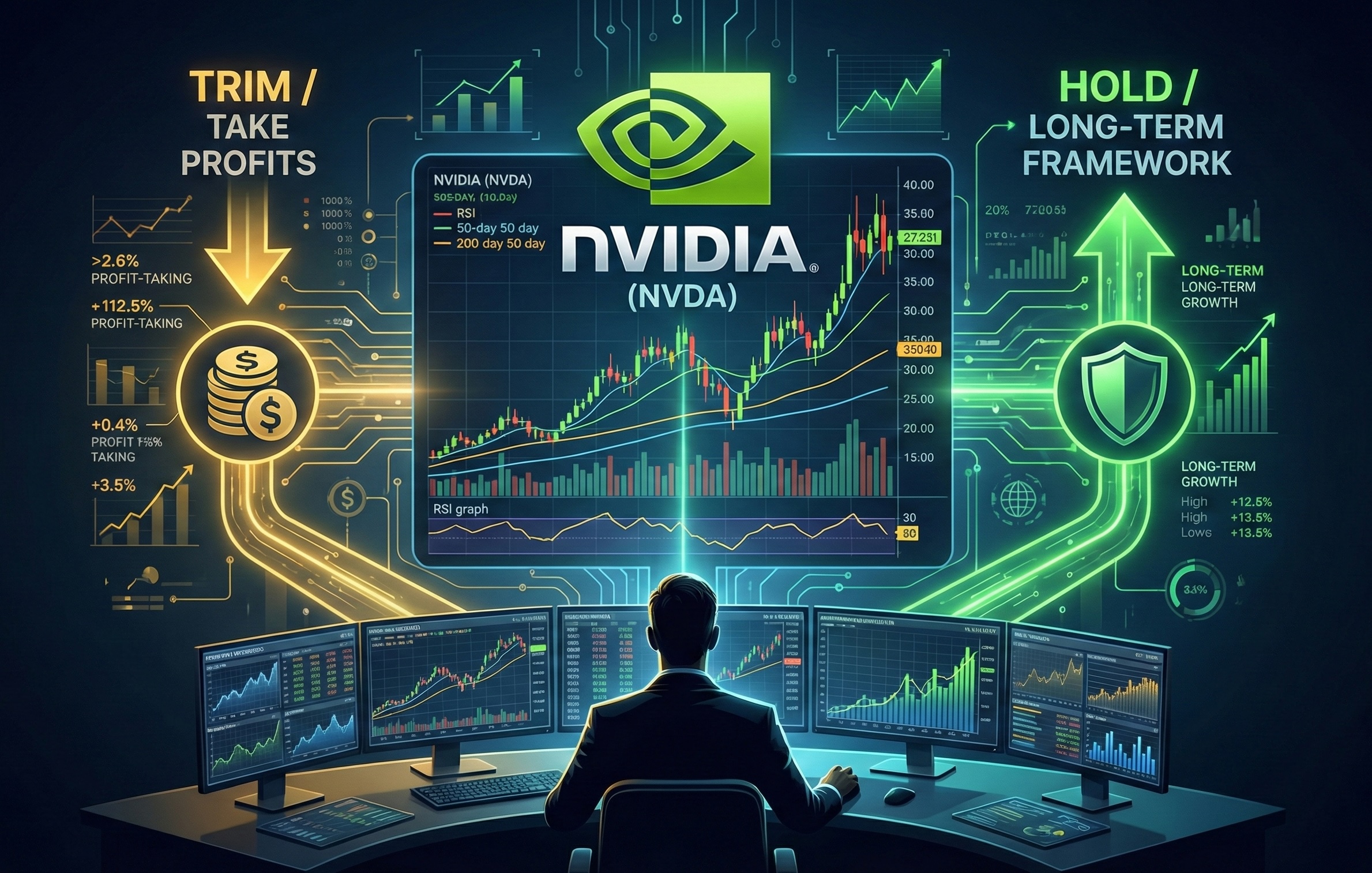

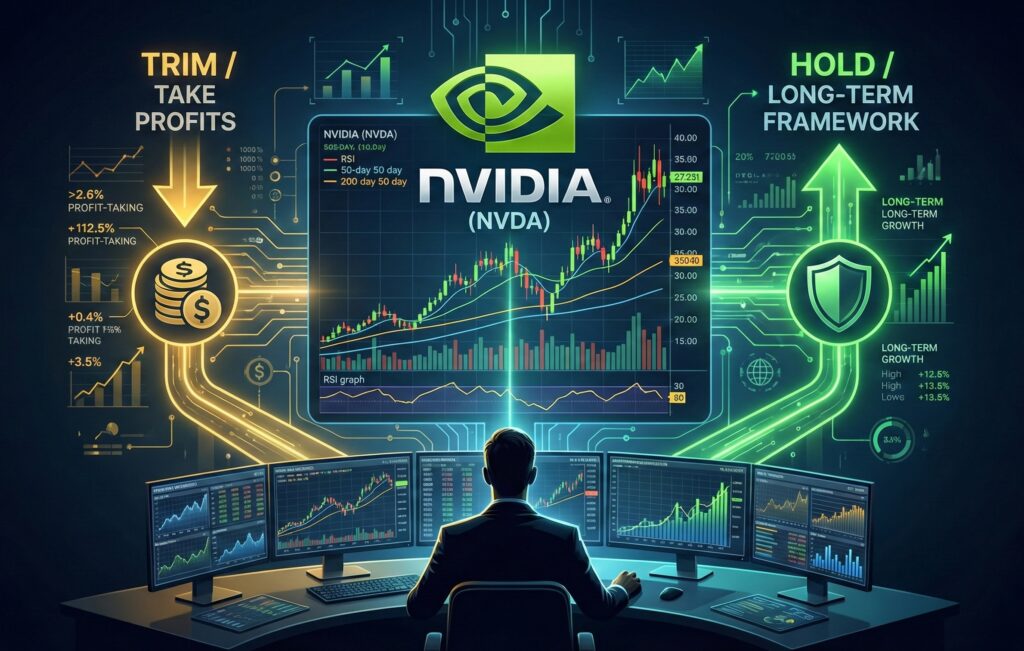

Pillar 1: The Art of Harvesting – NVIDIA Stock Profit Taking Strategies

One of the most underutilized strategies is also one of the most powerful: trimming. Selling doesn’t have to be an all-or-nothing decision. Knowing how to trim a stock position can be the key to sleeping well at night while keeping skin in the game.

Think of your portfolio like a garden. When a plant grows exceptionally well, you harvest some of its fruit without uprooting the entire plant. Trimming your NVIDIA position works the same way.

- The “House Money” Method: Sell enough shares to recoup your initial investment. Once your original capital is safe, the remaining shares in your portfolio can be considered “house money.” This psychologically liberating move allows you to participate in future upside with significantly reduced personal risk.

- Rebalancing for Risk: Has NVIDIA’s meteoric rise made it a dangerously oversized position in your portfolio? A common rule of thumb is to not let any single stock exceed 10-15% of your total portfolio value. Selling a portion to get back to your target allocation is not market timing; it’s disciplined risk management.

Trimming is a strategic compromise between fear and greed. It locks in real profits while allowing you to continue participating in the long-term growth story.

Pillar 2: The Market’s Pulse – Technical Analysis for NVDA

While fundamentals tell you about a company’s health, technical analysis can offer clues about market sentiment and momentum. For a stock as watched as NVIDIA, these indicators can be particularly insightful. We’ll focus on two of the most trusted indicators for deciding when to sell a winning stock.

- Moving Averages (The Trend Followers): The 50-day and 200-day moving averages are powerful indicators of short-term and long-term trends. A stock trading well above both is in a strong uptrend. A potential warning sign emerges if the price crosses below the 50-day average, indicating a potential shift in momentum. A cross below the 200-day average is a much stronger signal of a long-term trend change.

- Relative Strength Index (RSI) (The Overheating Gauge): The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100. A reading above 70 is generally considered “overbought,” and a reading below 30 is “oversold.” While NVIDIA has spent much of its run in the overbought territory, a sustained RSI above 80 can signal extreme speculation, suggesting a higher probability of a short-term pullback.

Technical indicators are not crystal balls. They are probabilistic tools. Use them not as absolute sell signals, but as data points to inform your level of caution.

Pillar 3: The Bedrock of Value – NVIDIA Fundamental Analysis 2025

The hype around NVIDIA is immense, but a durable investment case must be built on more than just sentiment. It requires a sober look at the company’s underlying business performance and future prospects. This is where NVIDIA fundamental analysis 2025 comes in.

Ask yourself these critical questions:

- Is the Valuation Justifiable? Look at the forward Price-to-Earnings (P/E) ratio. While high for a normal company, how does it compare to its projected earnings growth rate (the PEG ratio)? A PEG ratio near 1 can suggest the valuation is reasonable relative to its high growth. Check reputable sources for analyst earnings estimates.

- How Durable is the Moat? NVIDIA’s CUDA software platform creates a powerful competitive moat. How are competitors like AMD and Intel progressing in their efforts to challenge it? Is the moat widening or narrowing?

- Are Growth Drivers Intact? Data Center revenue is the key engine. Dig into their quarterly reports. Is that growth accelerating or decelerating? Are new segments like Automotive and Professional Visualization contributing meaningfully?

If you can no longer make a compelling case for the company’s future growth based on fundamentals, or if the valuation seems utterly disconnected from reality even by optimistic standards, the argument for selling becomes much stronger.

Bringing It All Together: Your Personal Decision Framework

Now, let’s integrate these three pillars into a simple checklist. Score each question from 1 (Bearish) to 5 (Bullish) to get a quantitative feel for your position.

- Profit Taking/Risk Management: Is my NVDA position over-concentrated in my portfolio? (1=Dangerously high, 5=Well-balanced)

- Technical Analysis: Is the stock showing signs of momentum loss or extreme overbought conditions? (1=Breaking below key MAs, 5=Strong uptrend)

- Fundamental Analysis: Can I still confidently justify the valuation based on future growth prospects? (1=No, valuation is absurd, 5=Yes, growth story is intact)

Tally your score. A low score might suggest that trimming or selling is a prudent move, while a high score could bolster your conviction to hold. The number itself is less important than the process of thinking through these questions systematically.

Conclusion: From Anxious Holder to Empowered Investor

The question of whether to sell NVIDIA is not a simple one, but it is answerable with a sound strategy. By shifting from an all-or-nothing mindset to a disciplined framework of trimming, technical observation, and fundamental analysis, you move from a state of anxiety to a position of control. You become an active manager of your own success.

Ultimately, the best decision is the one that aligns with your personal financial journey and allows you to sleep soundly. Don’t try to predict the future. Instead, build a framework that prepares you for it. That is the hallmark of a truly great investor.

This article is for informational purposes only and should not be considered financial advice.