How to Start Investing with Just $1,000: A 5-Step Guide for Beginners

You have $1,000. It’s a significant sum, earned through hard work and discipline. You know this money should be doing more than just sitting in a bank account, slowly being eroded by inflation. You’ve heard the investing gospel—the stories of compounding and wealth creation. Yet, you’re paralyzed. The financial world feels like a labyrinth designed by insiders, for insiders, filled with jargon and risk at every turn. What if you make the wrong choice?

This guide is your map and compass. The core truth is that starting to invest with a modest amount has never been more accessible than it is today. Forget the old image of needing a fortune and a personal broker. We will demystify the process and provide you with three clear, actionable paths to turn that $1,000 into the foundation of your financial future. This isn’t about getting rich overnight; it’s about taking the single most important step in the journey of a thousand miles.

The Silent Cost of Inaction: Why Your $1,000 Needs a Job

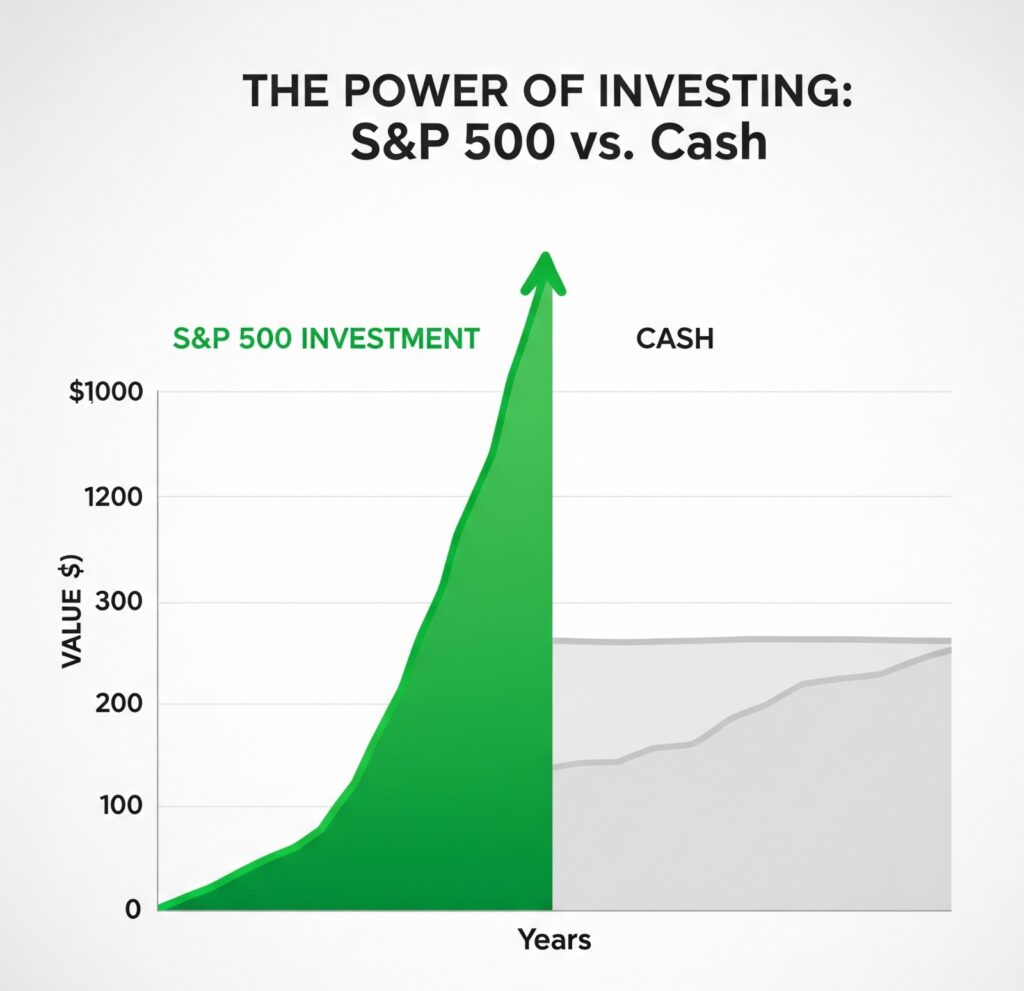

Before we explore the “how,” let’s anchor ourselves in the “why.” The most significant risk for your savings isn’t a market downturn; it’s inflation. Think of inflation as a slow, silent leak in your financial boat. According to data from the Federal Reserve, long-term inflation averages around 2-3% per year. This means that in a decade, your $1,000, if left in cash, could have the purchasing power of only about $820.

Now, consider the alternative. The S&P 500, a basket of the 500 largest U.S. companies, has historically delivered an average annual return of around 10%. This is the power of putting your money to work.

The First Principle of Wealth: Compounding is the engine of financial growth. The fuel for that engine is not a massive initial sum, but time. The sooner you start, the more powerful the effect.

The Three Modern Paths for the New Investor

For those investing for beginners with little money, the digital revolution in finance has opened up three primary, highly effective avenues. Let’s analyze each.

Path 1: The Digital Autopilot (Robo-Advisors)

Imagine hiring a personal trainer who creates a custom workout plan based on your fitness goals, age, and risk tolerance. A robo-advisor does precisely that for your money. It’s a software-driven platform that uses algorithms to build and manage a diversified investment portfolio for you.

How it Works:

You answer a simple online questionnaire about your financial goals (e.g., retirement, a down payment) and your comfort with risk. The robo-advisor then automatically invests your $1,000 into a mix of low-cost Exchange-Traded Funds (ETFs). It handles everything—rebalancing, dividend reinvesting, and adjustments—without you needing to lift a finger.

Pros:

- Simplicity: It’s the ultimate “set it and forget it” approach.

- Diversification: Instantly diversified across thousands of stocks and bonds, a feat difficult to achieve manually with $1,000.

- Low Minimums: Many platforms let you start with as little as $1.

Cons:

- Management Fees: While low (typically 0.25% – 0.50% per year), they are higher than a pure DIY approach.

- Less Control: You are outsourcing the decision-making, which might not appeal to those who want a hands-on experience.

Best for: The investor who values simplicity and wants a professionally managed, diversified portfolio without the high cost of a human advisor.

Path 2: The DIY Building Blocks (Index Fund ETFs)

If a robo-advisor is a pre-fixed menu, buying an index fund ETF is like buying a high-quality, all-in-one meal kit. An ETF is a fund that trades on an exchange like a stock, but it holds a multitude of underlying assets, such as stocks or bonds. An index fund ETF specifically aims to replicate the performance of a major market index, like the S&P 500.

How it Works:

Instead of trying to pick individual winning stocks (like finding a needle in a haystack), you buy a single share of an ETF that represents the entire haystack. For example, buying one share of an S&P 500 ETF (like VOO or IVV) makes you a part-owner of all 500 companies in the index.

Pros:

- Ultra-Low Cost: Expense ratios for major index ETFs can be as low as 0.03%, meaning almost all of your return is yours to keep.

- Transparency & Control: You decide exactly which indexes you want to own and when to buy or sell.

- Proven Performance: Over the long term, very few professional fund managers consistently beat the market indexes.

Cons:

- Requires Some Action: You are responsible for choosing the ETF and executing the trade through a brokerage account. You must also have the discipline not to panic-sell during market dips.

Best for: The cost-conscious beginner who is willing to do a small amount of initial research and wants to be in the driver’s seat. The robo-advisor vs ETF for beginners debate often comes down to this trade-off between convenience and cost.

Path 3: The Ownership Slice (Fractional Shares)

What if you want to own a piece of a powerhouse company like Amazon or Google, but a single share costs thousands of dollars? Fractional shares are the answer. They are exactly what they sound like: a piece of a single, expensive share.

How it Works:

Most modern brokerage apps now allow you to invest by dollar amount instead of by share count. You can decide to invest, say, $50 into Amazon. You won’t own a full share, but you will own a fraction of one, and your investment’s value will move in direct proportion to the stock’s price.

Pros:

- Accessibility: Allows you to invest in high-priced, high-growth companies with very little money.

- Easy Diversification: You can use your $1,000 to build a portfolio of 10-20 different blue-chip companies, which was previously impossible.

Cons:

- Higher Risk: Owning individual stocks is inherently riskier than owning a diversified index fund. A single company can fail.

- Psychological Pitfalls: The temptation to trade frequently or chase “hot” stocks is much higher.

Best for: The beginner who understands the risks and wants to build a custom portfolio of specific companies they believe in for the long term.

Your First $1,000: A Sample Portfolio Blueprint

Theory is one thing; action is another. Here is a tangible fractional shares investing example and ETF combination to illustrate how to build a simple portfolio. This is a balanced, growth-oriented approach for a beginner with a long-term horizon.

The $1,000 “Core & Explore” Portfolio

This strategy provides a stable foundation while allowing for a small allocation to individual companies you want to own.

- $700 (70%) – The Core: Invest in a Total Stock Market Index Fund ETF.

- Why: This is your foundation. It provides maximum diversification across the entire U.S. stock market (large, mid, and small-cap companies), all in a single, ultra-low-cost fund. It’s the ultimate “buy the haystack” strategy.

- Example ETF: VTI (Vanguard Total Stock Market ETF)

- $300 (30%) – The Explore: Use fractional shares to buy pieces of 3-5 world-class companies you understand and believe in for the long run.

- Why: This portion keeps you engaged and allows you to invest in dominant businesses that are shaping the future. The key is to think like an owner, not a speculator.

- Example Allocation:

- $75 in a technology leader (e.g., Apple or Microsoft)

- $75 in a consumer giant (e.g., Amazon or Costco)

- $75 in a financial powerhouse (e.g., Berkshire Hathaway or Visa)

- $75 in a healthcare innovator (e.g., Johnson & Johnson or UnitedHealth Group)

Conclusion: From Potential to Portfolio

We have navigated the labyrinth. The path from having $1,000 in potential to a $1,000 working portfolio is not through a secret door, but through a clear, well-lit hallway with three distinct entry points: the automation of robo-advisors, the elegant simplicity of index funds, or the direct ownership of fractional shares.

The most profound insight is this: the “perfect” portfolio is less important than the “started” portfolio. The analysis paralysis that keeps so many beginners on the sidelines is a far greater threat to your wealth than choosing a reputable, low-cost index fund over a slightly different one. Your first $1,000 is not your last; it is your first. It is a tool for learning and a down payment on your future self. Choose a path, take the first step, and let the power of compounding begin its quiet, relentless work.

This article is for informational purposes only and should not be considered financial advice.