The 3 Hidden Risks of Bond ETFs (And How to Mitigate Them)

In the world of investing, bond ETFs are often portrayed as the calm, reliable sibling to volatile stocks. They offer diversification, simplicity, and a steady stream of income. But to build true, lasting wealth, a savvy investor must look beyond the sales pitch and ask the most important question: “What could go wrong?” While bond ETFs are certainly safer than many alternatives, they are not without risk. Ignoring these risks is like sailing in calm seas without checking the forecast.

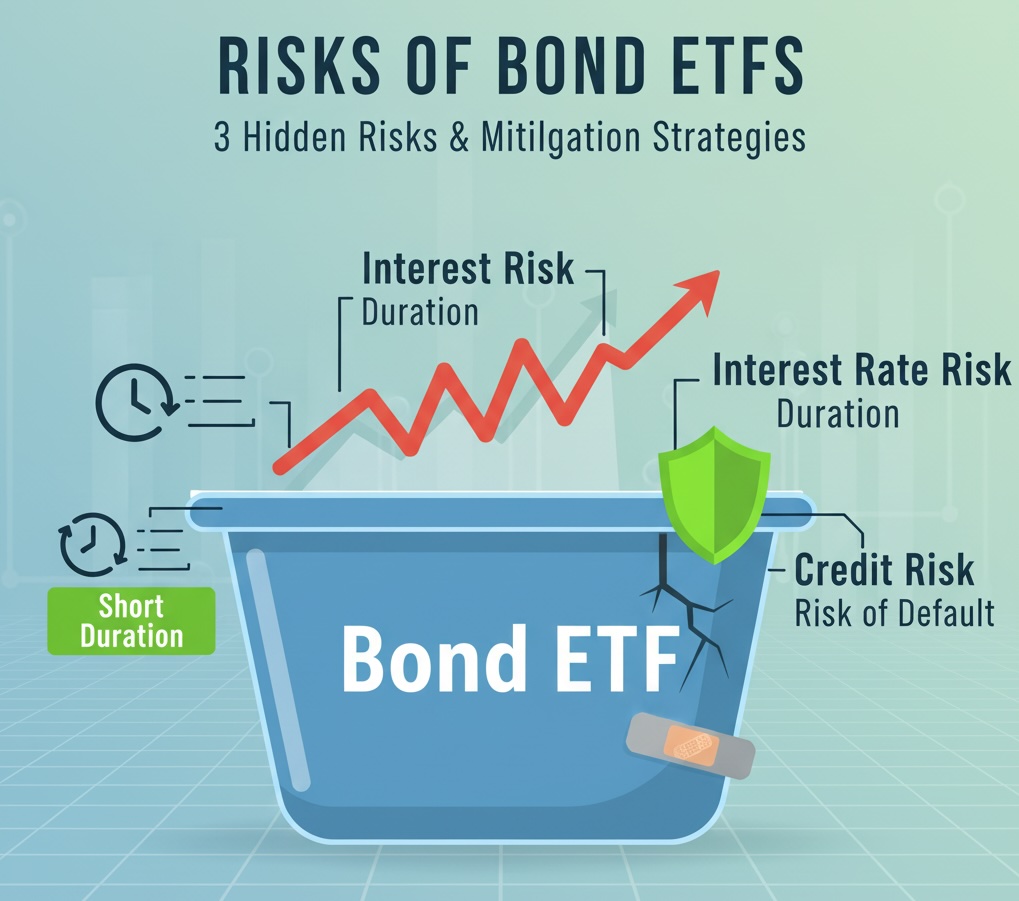

This article pulls back the curtain on the three primary risks every bond ETF investor must understand. More importantly, it will provide you with a clear, actionable playbook to navigate them, ensuring your safe harbor remains secure, no matter which way the economic winds blow.

Risk 1: Interest Rate Risk (The Seesaw Effect)

This is the most significant risk for most bond ETF investors. Imagine a seesaw. On one end sits the market’s interest rates, and on the other, the price of your bond ETF. When interest rates go up, the price of existing bonds (and the ETF that holds them) goes down. Why? Because new bonds are being issued with more attractive, higher yields, making the older, lower-yielding bonds in your ETF less desirable.

This relationship is quantified by a metric called “duration.” In simple terms, duration measures how sensitive your bond ETF’s price is to a 1% change in interest rates. A bond ETF with a duration of 7 years would be expected to lose approximately 7% of its value if interest rates rise by 1%.

Think of duration as the length of the seesaw. A longer seesaw (higher duration) means a small push on one end creates a much bigger movement on the other. A shorter seesaw (lower duration) is more stable.

How to Mitigate Interest Rate Risk:

The strategy is straightforward: know and manage your ETF’s duration. In a rising-rate environment, as we’ve seen discussed by the Federal Reserve, investors often shorten their duration to reduce price sensitivity. You can do this by choosing ETFs specifically labeled as “short-duration” or “ultra-short-duration.” These funds are designed to be less volatile when rates change.

Risk 2: Credit Risk (The Borrower’s Promise)

When you own a bond ETF, you are lending money to governments and corporations. Credit risk is the danger that these borrowers won’t be able to pay back their loans. If a major holding in your ETF defaults, the fund’s value can take a hit. While diversification helps cushion this blow, it doesn’t eliminate the risk entirely, especially in ETFs focused on a specific sector.

Bond ETFs are generally categorized by credit quality, from ultra-safe U.S. Treasury ETFs to riskier “high-yield” or “junk bond” ETFs. High-yield bonds offer higher income because you are being compensated for taking on greater credit risk—lending to companies with weaker financial standing.

Risk vs. Reward: A Quick Guide

- U.S. Treasury ETFs: Considered to have virtually zero credit risk.

- Investment-Grade Corporate ETFs: Low to moderate credit risk. Hold bonds from financially stable companies.

- High-Yield (Junk) Corporate ETFs: Significant credit risk. Offer higher potential returns but with higher potential for defaults.

How to Mitigate Credit Risk:

Align the ETF’s credit quality with your risk tolerance. If your primary goal is capital preservation, stick with ETFs that hold U.S. Treasuries or high-quality, investment-grade corporate bonds. You can verify the credit quality of an ETF’s holdings by checking its summary prospectus on the fund provider’s website or through rating agencies like Moody’s and S&P.

Risk 3: Lack of a Maturity Date (The Perpetual Loan)

When you buy an individual bond, you have a clear contract: at the end of a specific term (the maturity date), you get your principal back. This provides a predictable anchor, especially if you hold to maturity. A bond ETF, however, never matures. It is a perpetual portfolio; the fund manager is constantly buying and selling bonds to maintain the fund’s target strategy (e.g., a 5-7 year duration).

This means there is no future date when you are guaranteed to get your original investment back. The only way to retrieve your principal is to sell your shares at the current market price, which could be higher or lower than what you paid. This exposes you to market fluctuations that an individual bond held to maturity would avoid.

How to Mitigate This Risk:

Shift your mindset from a fixed-term loan to a perpetual income stream. The strength of a bond ETF isn’t a guaranteed return *of* principal, but a diversified return *on* principal through dividends. If a specific future liability is your goal (e.g., a down payment in 5 years), a portfolio of individual bonds maturing on that date—or a target-date bond ETF—might be a more suitable tool. For most investors focused on long-term portfolio stability, the liquidity and diversification of a standard bond ETF outweigh the lack of a maturity date.

Conclusion: The Informed Investor’s Edge

Bond ETFs are a phenomenal tool, but they are not a magic bullet. True financial acumen lies not in finding risk-free investments, but in understanding, measuring, and managing risk intelligently. By grasping the dynamics of interest rate risk, credit risk, and the perpetual nature of the ETF structure, you move from being a passive passenger to an active navigator of your financial journey.

The key is alignment. Align your choice of ETF with the interest rate environment, your personal tolerance for credit risk, and your long-term goals. This informed approach is what separates amateur speculation from professional investing, giving you the confidence to build a truly resilient portfolio.

This article is for informational purposes only and should not be considered financial advice.