The SAFE Withdrawal Strategy for Retirees in 2025: How to Make Your Money Last

Introduction

For decades, retirees have clung to a simple rule for financial survival: the 4% rule. But in 2025, does that rule still hold water, or is it a leaking life raft in a sea of economic uncertainty? You’ve spent a lifetime building your nest egg; the single most important financial question now is how to draw from it without the terrifying prospect of running out of money. This article will not only dissect the elegant but outdated 4% rule but also introduce you to sophisticated, battle-tested withdrawal strategies designed for today’s volatile markets, complete with a tool to model your own financial future.

The Allure and The Flaw of a Simple Number

The 4% rule, first proposed by financial advisor William Bengen in 1994, was revolutionary in its simplicity. It suggested that retirees could safely withdraw 4% of their initial portfolio value in the first year of retirement, and then adjust that amount for inflation each subsequent year, with a very high probability of their money lasting for 30 years.

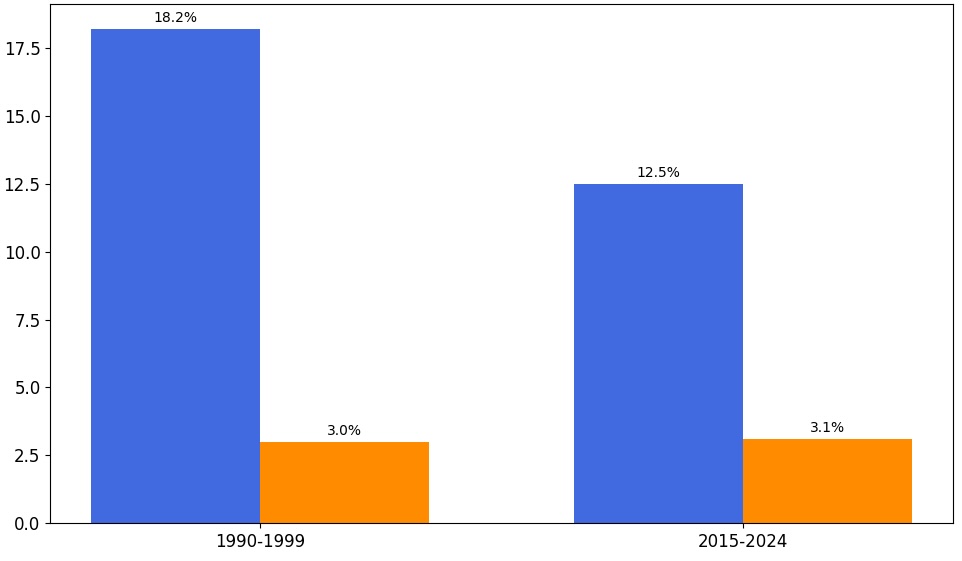

This strategy was born from a specific historical context—a post-war American economy characterized by soaring stock market returns and relatively stable bond yields. It was a “set it and forget it” approach that offered peace of mind.

A Simple Analogy: Imagine your retirement portfolio is a large reservoir of water. The 4% rule is like opening a tap to a fixed diameter, assuming the reservoir will be replenished by rainfall (market returns) at a predictable rate. For a long time, the rain fell as expected.

However, the financial climate of 2025 is a world away from the 1990s. We face a different beast: lower projected returns, higher inflation volatility, and unprecedented global economic shifts.

As the chart above illustrates, relying on historical averages can be misleading. The “rainfall” is no longer as predictable. A series of bad market years early in your retirement (known as sequence of returns risk) could drain your reservoir much faster than the 4% rule anticipates.

Beyond the 4%: Three Modern Withdrawal Strategies for 2025

True financial security in retirement requires a more dynamic approach. Let’s explore three powerful strategies that adapt to reality.

1. The Dynamic Withdrawal Strategy: The Smart Thermostat

Instead of a fixed withdrawal, this strategy adjusts your spending based on market performance. Think of it as a smart thermostat for your finances.

- How it works: You set a base withdrawal percentage (e.g., 4.5%), but you also establish “guardrails.” For example, if your portfolio’s value drops by 10%, you might reduce your withdrawal by 10% for the following year. Conversely, if it grows by 10%, you could give yourself a raise.

- Pros: It dramatically reduces the risk of portfolio depletion during market downturns. It’s intuitive and directly links your spending to your portfolio’s health.

- Cons: It requires more hands-on management and emotional discipline. You must be willing to cut back on spending when markets are down.

The Guardrail Method in Action

- Portfolio: $1,000,000

- Base Withdrawal: 5% ($50,000/year)

- Guardrails: +/- 20% portfolio value change triggers a +/- 10% spending change.

- Scenario: The market falls 20% in Year 2. Your portfolio is now ~$800,000.

- Action: In Year 3, you reduce your withdrawal by 10% to $45,000. This painful but prudent cut significantly increases the long-term viability of your funds.

2. The Bucket Strategy: The Financial Triage System

Popularized by financial planning expert Harold Evensky, the bucket strategy mentally divides your assets into three distinct pools.

- Bucket 1: Cash (1-3 years of living expenses). This is your short-term fund, held in cash, savings accounts, or short-term CDs. It’s immune to market volatility and covers your immediate needs.

- Bucket 2: Income (3-10 years of expenses). This bucket is typically invested in high-quality bonds and dividend-paying stocks. Its goal is to generate stable income and preserve capital, acting as a buffer for Bucket 1.

- Bucket 3: Growth (10+ years of expenses). This is your long-term growth engine, invested in a diversified portfolio of global stocks and other growth assets. This is where you’ll see the most volatility but also the highest potential returns.

The strategy is to spend from Bucket 1, and periodically refill it by selling appreciated assets from Bucket 2 or 3 during favorable market conditions. This prevents you from being forced to sell stocks during a downturn to cover living expenses.

3. The Annuitization Strategy: Buying Your Own Pension

While not a withdrawal strategy in the traditional sense, creating a floor of guaranteed income is a cornerstone of modern retirement planning. A portion of your assets can be used to purchase a single premium immediate annuity (SPIA), which provides a guaranteed monthly check for life.

- How it works: You give an insurance company a lump sum, and they, in turn, promise to pay you a fixed amount regularly. This covers your essential expenses (housing, food, healthcare), while the rest of your portfolio can be managed for discretionary spending and growth.

- Pros: Unmatched peace of mind. It eliminates longevity risk (outliving your money) and market risk for your core income needs.

- Cons: You lose control over the lump sum you annuitize. Annuity returns can be modest, and they can be complex products.

Conclusion: From a Simple Rule to a Sophisticated Strategy

The era of relying on a single, static number for your retirement income is over. The financial landscape of 2025 and beyond demands a more intelligent, adaptive approach. The 4% rule served its purpose as a starting point, but clinging to it now is like navigating a modern highway with a map from the 1990s.

The true insight is this: the safest withdrawal strategy isn’t a number, but a framework. By combining the discipline of dynamic adjustments, the structural safety of the bucket system, and the security of an income floor, you move from being a passive passenger to an active pilot of your own retirement journey. You can build a resilient income stream that not only weathers market storms but allows you to thrive for decades to come.

This article is for informational purposes only and should not be considered financial advice.