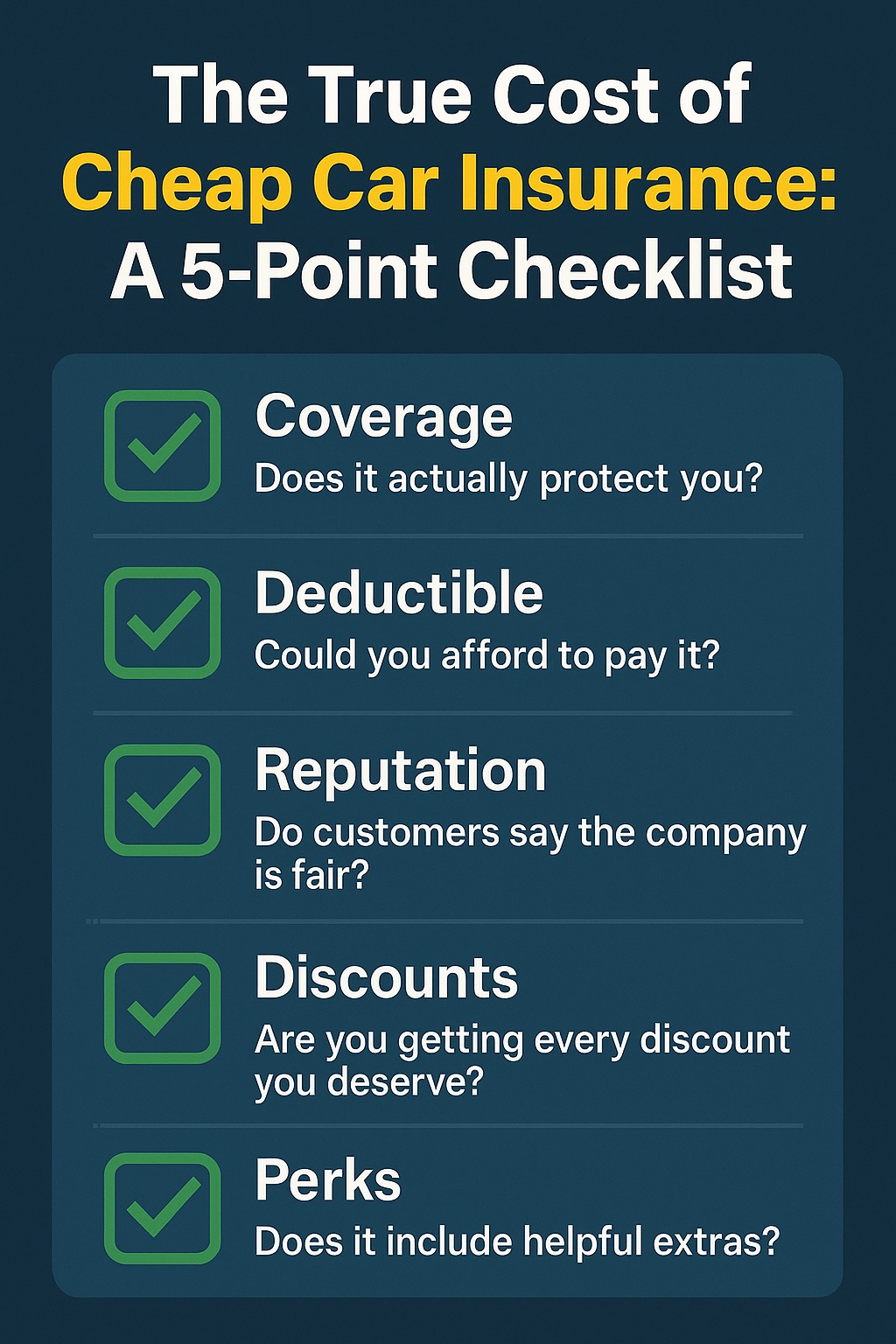

The True Cost of Cheap Car Insurance: A 5-Point Checklist

The True Cost of Cheap Car Insurance: A 5-Point Checklist

You’ve spent hours jumping between insurance websites, typing in your info, and then you see it: a quote that’s way cheaper than all the others. It seems like a no-brainer, right?

Hold on before you click that “buy” button. While everyone loves a good deal, chasing the lowest possible price on car insurance can backfire, big time. That super-cheap plan today could become a huge financial nightmare tomorrow if it doesn’t have your back when you actually need it.

This 5-point checklist breaks down what you really need to look for. It’ll help you see past the price tag and find a policy that gives you real value and peace of mind on the road.

1. Your Coverage Levels – Are You Actually Covered?

Why it matters: This is the most important part of your policy—it’s the section that spells out what the insurance company will actually pay for. Just meeting the legal minimum is often a risky move that can leave you on the hook for a massive bill after a serious accident.

Think of coverage in three basic layers:

- Liability Coverage: This is the bare-minimum coverage required in most places. It pays for damage you cause to other people and their property. The key thing to remember is that it does nothing to cover your own car or your own injuries.

- Fire & Theft Coverage: A step up from liability, this layer adds protection in case your car is stolen or damaged in a fire.

- Comprehensive Coverage: This is the top-tier option that covers all the above, plus damage to your own car—even if the accident was your fault. It also typically covers things like vandalism, storm damage, or hitting an animal.

2. Your Deductible – How Much You Pay First

Why it matters: Your deductible is the amount of cash you have to pay out of your own pocket on a claim before your insurance coverage kicks in. Insurance companies often dangle a low monthly premium by attaching it to a sky-high deductible.

It’s a simple trade-off:

- A higher deductible usually means a lower monthly bill.

- A lower deductible usually means a higher monthly bill.

The Golden Rule: Never choose a deductible you couldn’t comfortably pay tomorrow without panicking. If you don’t have $1,000 sitting in your emergency fund, don’t pick a $1,000 deductible just to save a few bucks a month.

3. The Company’s Reputation – Will They Be There for You?

Why it matters: A cheap plan from a bad company is a waste of money. When you need to file a claim, you want a helpful, responsive team—not a company that will fight you every step of the way.

Before you sign up, do a quick background check:

- Read Customer Reviews: Check trusted sites like Google Reviews or Trustpilot to see what real customers are saying, especially about the claims process.

- Look Up Complaint Records: See if your state or country has an official department of insurance that tracks customer complaints filed against companies.

- Check Financial Ratings: Look for ratings from independent agencies (like A.M. Best) to make sure the company is financially stable and can afford to pay out claims.

4. Discounts – Are You Leaving Money on the Table?

Why it matters: Insurance companies reward safe drivers and loyal customers, but they don’t always hand you the savings automatically. You often have to ask for the discounts you qualify for. 💰

Make sure you’re asking about these common price breaks:

- A Clean Record: This is usually the biggest discount. Insurers offer a “claims-free” or “good driver” discount that gets bigger every year you drive without an accident.

- Bundling Your Policies: You can almost always save money by getting your car and home (or renter’s) insurance from the same company.

- Vehicle Safety Features: Having an anti-theft system, airbags, and other safety features can trim your bill.

- Usage-Based Programs: Many insurers now offer “telematics” programs that use a small device or app to track your driving. Driving safely can earn you a serious discount.

5. Helpful Perks – The ‘Little Things’ That Matter

Why it matters: An accident is a major headache. Sometimes, it’s the small perks in a policy that can make a huge difference in getting your life back to normal.

Look for these valuable extras:

- Rental Car Reimbursement: This is a cheap add-on that covers the cost of a rental car while yours is in the shop after an accident. It can save you hundreds of dollars.

- Roadside Assistance: For just a few dollars a month, this feature can rescue you if you get a flat tire, your battery dies, or you need a tow.

Your Smart Shopping Checklist

When you’re comparing quotes, remember to look beyond the price.

- Coverage: Does it actually protect you, or is it just the bare minimum?

- Deductible: Could you afford to pay it, no questions asked, tomorrow?

- Reputation: Do customers say the company is fair and easy to work with?

- Discounts: Are you getting every single discount you deserve?

- Perks: Does it include helpful extras like rental coverage?

At the end of the day, the best car insurance isn’t just the cheapest one—it’s the one that lets you drive without worrying. Shop smart! 👍